Using Housing Wealth for Long-Term Care Plan

7 Ways to Fund a Long-Term Care Plan with Housing Wealth

By Don Graves, PMC-LLC Coach

As CLTC designees, we know the truth that most people will need extended care at some point in their lives, but many mistakenly believe that Medicare will cover the costs. The reality is: unless retirees are eligible for Medicaid, they are responsible for their own long-term care plan.

Often, you may help your clients purchase long-term care insurance, or they may acquire a life insurance policy or annuity that has long-term care provisions built in. Today, we’ll consider another resource—one that’s readily available and easily accessible, yet often overlooked by advisors. It’s your clients’ housing wealth.

Currently, around 87% of baby boomers and existing retirees own their home, and according to the U.S. Census Bureau, their home equity accounts for a considerable portion of their total wealth (68%). However, it can only be utilized as an asset, if it can be accessed! This is where the reverse mortgage can play an important role.

Reverse Mortgages, Are You Kidding?

Let’s be honest; the reverse mortgage comes with “baggage.” Historically, moderate to affluent retirees and their advisors have either dismissed the reverse mortgage as irrelevant (or even dangerous), or they have relegated it to a last-resort option.

However, much has changed. FINRA changed their position, and recent research conducted by Nobel Prize winners, financial thought leaders, prestigious academic institutions, and scholarly journals now affirms the role that the strategic use of reverse mortgages can play in comprehensive retirement planning including extended care planning. As a matter of fact, since December of 2018, the nation’s largest broker dealer as well as many others have removed restrictions on discussing reverse mortgages with their clients.

By no means am I suggesting a reverse mortgage is right for every client, but I do believe that the newly-restructured reverse mortgage is uniquely designed to address the most common concerns of retirement and is worth a conversation. Here’s a quick overview.

How Do They Work?

The most common type of reverse mortgage is Home Equity Conversion Mortgage (HECM). It is a federally insured loan for those age 62 or better (only one spouse must be age 62) that allows them to convert a portion of their primary residence’s value into tax-free dollars. The borrower is not required to make any mortgage payments, though they have that option, and they do not give up ownership or come off title of the home.

A reverse mortgage must be a first mortgage. This means if a borrower has a remaining mortgage or home equity loan balance, they are required to pay it off when they close on the reverse mortgage.

The amount of money a borrower is eligible for is based on the age of the youngest borrower, the value of the property and the interest rate associated with the selected program. Proceeds can be taken in a lump sum, line of credit, monthly payment or a combination of these.

There are four basic requirements for the HECM: (1) the house must remain the principal residence of at least one of the borrowers; (2) the home must be maintained; (3) basic homeowner’s insurance must be kept in force; and (4) all property-related taxes must be paid.

And finally, the loan gets repaid when the last surviving borrower deceases or permanently leaves the property. When the home is no longer being used as the primary residence, the cash advances, interest and other financed charges must be repaid to the lender. This can be done from other assets, insurance or the heirs can refinance the existing property.

Most commonly, the home is sold to repay the loan, and one hundred percent of any remaining proceeds (beyond the amount that are owed) will belong to the borrower if they move, or to their estate if they decease. If the loan balance exceeds the sale proceeds, the remaining amount is covered by the FHA because it is a federally insured program. No debt is passed along to the borrowers’ beneficiaries.

The HECM Line of Credit

In the next section of this article, I will outline seven strategies for using the HECM to create an extended care plan, but first, it’s important we understand a bit more about the HECM Line of Credit.

Most of us are familiar with a traditional banking line of credit, or something like a Visa, Mastercard, or Discover credit card. They all work in a similar way. The bank/credit card company gives you the ability to borrow money (up to a limit) and then repay those advances over time. The reverse mortgage line of credit (ReLOC) works similarly, but with a few significant differences:

No Mandatory Monthly Payments. The ReLOC does not require any monthly loan payments on the money that is taken.

The Line of Credit Grows. The unused portion of the ReLOC has a built-in, guaranteed growth factor that allows it to grow regardless of the home’s value! This means you can secure a ReLOC and access more dollars down the road than what it was originally worth.

Table 1 below shows the projected growth of the ReLOC for a 62-year-old with $200,000, $400,000, and $600,000 home values. Notice how much the line has grown 25 years later, when the borrower is age 87.

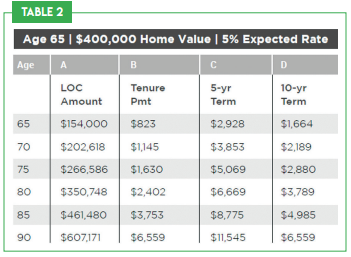

Another way you can receive the reverse mortgage funds is by converting all or some of the remaining line of credit into monthly payments. Table 2 shows the monthly payments available to a retiree (age 65) with a $400,000 home. Tenure payments exist as long as the loan is in effect, while term payments are set for specific periods of time (5 and 10 years, in this example).

7 Ways to Fund a Long-Term Care Plan with Housing Wealth

I’ve included the following examples from my recent book, The Retiree’s Guide to Housing Wealth (www. housingwealthbook.com). Like any reverse mortgage strategy, these approaches are designed for those who plan to remain in their homes for as long as possible (unless otherwise noted).

1 SELF-INURE

HECM Line of Credit Strategy

Establish a growing reserve of dollars with a HECM Line of Credit and use those funds as needed to cover long-term care costs without having the burden of a mandatory monthly loan payment. This strategy works best when the line of credit is established at the onset of retirement.

2 PREMIUM REPLACEMENT

HECM Replacement Strategy

Clients who have a current house payment can use the HECM Replacement strategy to pay off the loan. Now the money that was going towards their loan payment each month can be reallocated to cover long-term strategies such as premium payments for traditional LTCi or a 10/20 pay Hybrid.

3 MAXIMIZE YOUR “SELF-INSURE FUND”

HECM Exchange Strategy

If your clients are financially comfortable making monthly loan payments, they may continue doing so, but on the reverse mortgage. This reduces the outstanding balance of the HECM, while simultaneously adding funds to the available and growing line of credit for tax-free access in the future.

4 PREMIUM REPLACEMENT

HECM Monthly Payment Strategy

If premium payments are a burden on your clients’ monthly budget, they can convert their HECM Line of Credit to monthly payments and use the funds to cover their daily living expenses. Take note that the direct proceeds from a reverse mortgage should not be used to purchase or make direct payments on a product (like long-term insurance). In this case, the premium payments are coming from your clients’ income/savings, while the reverse mortgage covers or replenishes their daily essentials.

5 ACQUIRE INSURANCE

HECM for Purchase Strategy

In 2008, as part of the Housing and Economic Recovery Act (HERA), the U.S. Department of Housing authorized the HECM for Purchase (H4P). This reverse mortgage allows retirees to purchase a new home with the proceeds of the HECM financing a portion of the purchase price. A new home usually can be purchased with around a 50 to 60 percent downpayment and requires no monthly mortgage payments. Having proceeds left over after selling a home is normal for any retiree. Using the HECM for Purchase program is no different as it also will often result in remaining proceeds after the sale of the departure home. Your clients can look to those proceeds to strengthen their long-term care plan with extended care insurance coverage of some kind.

6 GAP FUNDING

HECM Monthly Payment Strategy

While your clients’ long-term care or life insurance should cover much of their cost of care, it may not cover everything. HECM monthly payments can help bridge the gap between what their insurance covers and what it does not. It can also fill in if they must leave their job early and need funding until their policy kicks in.

7 POLICY PRICING

HECM Line of Credit Strategy

For those who can qualify for and afford it, traditional long-term care insurance may be the best way to cover long-term care costs. However, to some, this type of insurance is considered more expensive. There are four pricing features on these policies, that when adjusted, can make the price more affordable.

Benefit Amount: How much per day the policy will pay.

Benefit Period: How long that amount will be paid.

Inflation Protection: How the benefit amount keeps pace with inflation over time.

Waiting Period: How long it will take before the policy begins paying.

Any adjustment in these four features can have a significant impact on premium costs. This is where the reverse mortgage can help. Not only can a repurposed mortgage payment cover the premium, but the establishing of the line of credit can create additional options. For example, your clients could choose a lower benefit amount or a shorter benefit period because the HECM line of credit can be converted to monthly payments to cover the shortfall.

They could also use the HECM Line of Credit growth as an inflation rider—allowing the inflation rider on the other policy to be lowered or even eliminated.

Finally, they could extend the waiting period; the longer the waiting period, the lower the premium for the policy. If they have medical expenses during the prolonged waiting period, they can pull from their established HECM line of credit to fund them.

Can You See the Value?

Protecting your clients’ assets in the case of an extended care event is an important feature of their retirement plan. Can you see how Housing Wealth gives advisors and their clients the flexibility to offer multiple variations of an extended care plan? By no means do we suggest that the reverse mortgage is the conclusion for every situation, but it should certainly be part of the conversation.

To download your one-page, Housing Wealth case study go to www.HW197.com.