Reverse Mortgages

Is a Reverse Mortgage Right for Your client?

By Don Graves, PMC-LLC Coach

Retirement is going to last longer and be less predictable than ever before. In addition, we are living longer, healthier lives, but with that comes the added stress of maintaining your desired lifestyle for a longer retirement.

Therefore, today’s retiree needs every legitimate tool available to meet their retirement goals. Reverse Mortgages have become one such tool.

Historically, the moderate to more affluent retiree has either simply dismissed the Reverse Mortgage or relegated it to use as a last resort. Much has changed and for many in the boomer generation to survive and thrive in retirement, a new way of thinking and a clear understanding of all the options open to them is required.

Reverse mortgages are still a relatively new concept to many, especially as a source of retirement income for seniors. However, in the last five years, there has been a major shift in the “retirement income planning” landscape. Housing wealth has emerged as a tool that’s dramatically changing people’s lives for the better.

Many in the financial advisor community have now come to believe that if certain desired retirement income levels are to be met, reverse mortgages must be considered.

By no means do I (or other thought leaders) suggest that a Reverse Mortgage is right for every client, but we do acknowledge the importance of housing wealth as a critical component in the retirement planning conversation.

The Rules Have Changed

Work longer, spend less, and save more are more often the rules for retirement than the exceptions. For many, 70 is the new 62. Three overarching themes about today’s retiree and pre-retiree are at the root of the problem.

Retirees are living longer than previous generations. Instead of spanning 15 or 20 years, today’s retirement will last 25, 30, or even 35 years or more. This length of time is something most people have not planned for.

Retirees have not saved enough to sustain retirement income for their projected lifespan. A longer retirement necessitates additional funding; add global economic uncertainty to the mix, and you’ve got one expensive quarter-century for which to plan. Even an attempt to increase saving in the years leading up to retirement will not make up for the compounding interest that could have been earned over the course of their careers.

Retirees will carry more consumer debt into retirement than previous generations. Much of the baby boomers’ money in retirement will be tied up in debt they accumulated during their working years. This can be especially problematic when transitioning to fixed income.

The Risks Are Different

Traditionally, retirement planning was focused on getting to the top of the mountain, sometimes compared to climbing Mount Everest, a metaphor that leaves no illusions about retirement challenges.

The goal was to save all you could, get to the top, plant your flag, and live off what you had amassed. This is commonly referred to as the Accumulation Phase, and its primary focus is on asset allocation - diversifying holdings among different types of investments to balance risks and rewards.

But it’s the second part of the retirement journey, the descent - also known as the Distribution or Decumulation phase - that has proved to be the more difficult of the two because financial risks don’t dissipate upon entering retirement; they increase!

Once you retire, there is a heightened risk of running out of savings or having to substantially reduce your lifestyle. The American College of Financial Services has identified eighteen major risks distinctly associated with and amplified by descending the retirement mountain. I will briefly highlight four.

The Resources Are Insufficient

The rules have changed, and the dangers have grown, but the retirement resources we have relied upon can no longer be solely relied upon to carry us the distance.

For years, retirees have had three primary sources of wealth to work within creating a retirement income plan: The Income Bucket (Social Security, pension, employment, etc.), the Investment Bucket (IRA, 401k, 403b, CD’s, Money Market, etc.) and the Insurance Bucket (annuities, life insurance, business to be sold, second home, etc.).

It was from these available sources that retirees and their advisors sought to create lifetime income while attempting to lessen risk and maintain their desired lifestyle. But in modern times, are these three buckets of wealth and traditional planning tools enough to create the retirement you deserve?

In my experience, the answer is no. Retirees are living longer and have not saved nearly enough to maintain the type of retirement they desire. The good news is there is an additional bucket that’s easily accessible to most retirees: Home Equity.

The Fourth Bucket: Home Equity

Make no mistake, the presence of home equity in retirement is significant. Currently, there is more than 7.5 trillion dollars in senior home equity. 87 percent of baby boomers and existing retirees own their home. The U.S. Census Bureau states that the average retiring 65-year-old couple will have 68 percent of their total wealth tied up in their home equity. “Retirees simply cannot afford to continue to ignore home equity as an income source and still meet their retirement goals’ – Professor Jamie Hopkins as quoted in CNBC Article.

THE NEWLY RESTRUCTURED REVERSE MORTGAGE

For years, it was wrongly believed that reverse mortgages were just for house-rich, cash-poor seniors (though, they never really were). Today’s savvy retirees are more sophisticated, well-read, and proactive in doing their homework and are finding something different. Thanks to the recent research of scholars, institutions, and financial thought leaders, this is a very different list of borrowers than just a few years ago.

Exploring the Reverse Mortgage

Since its inception in 1961, there have been four primary types of reverse mortgages. Proprietary Reverse Mortgages (1961). Home Equity Conversion Mortgages (1988). Jumbo Reverse Mortgages (2000). Purchase Reverse Mortgages (2009).

By far, the most common type of Reverse Mortgages is called the Home Equity Conversion Mortgages (HECM). It is part of the Federal Housing Administration (a division of the United Dept. of Housing and Urban Development – HUD) and accounts for nearly 95 percent of all reverse mortgages. This article will focus primarily on the HECM.

The HECM Reverse Mortgage is a federally insured loan for those age 62 or better (only one spouse must be age 62, except for TX) that allows them to convert a portion of their primary residence’s value into tax-free dollars. The borrower is not required to make any mortgage payments (though they have that option) and they do not give up ownership or come off the title of the home.

A Reverse Mortgage must be a first mortgage. This means if you have a remaining mortgage or home equity loan balance, you are required to pay it off when you close on the reverse mortgage. You must also live in the home. The property can be a single-family home, a HUD-qualified condo or manufactured home, or a one-to-four-unit home where you live in one of the four units.

To qualify, the borrower will also need to prove their willingness and capacity to meet their monthly obligations. Questions such as: Have you paid your property-related taxes, insurance, and any monthly mortgage payments in a timely manner over the last 2-3 years will be asked, as well as the amount of residual income you must have in order to meet basic housing obligations.

How Much Can You Qualify For?

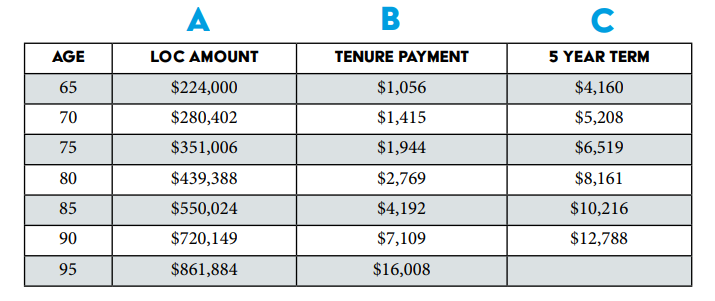

The amount of money a borrower is eligible for is based on three primary factors: The age of the youngest borrower. (A recent change to the program allows for the younger spouse to remain in the home should the older spouse predecease them. In this case, the age of the younger spouse will be used to calculate the benefit.) The value of the property up to the current lending limit ($825,375 for HECM at time of printing) and $10 million for the Jumbo’s. The long-term interest rate associated with the selected program.

How Can Proceeds Be Distributed?

There are typically five ways in which you can receive your money. These include: Lump Sum: As a protective feature, the borrower can only receive 60 percent of the available benefit in the first year and the remainder after that. Line of Credit: The ability to tap into an increasing reserve of dollars as needed. Regular Tenure Payments: A regular, monthly payment, backed by the federal government and guaranteed to come to the borrower for as long as the loan is open. Regular Term Payments: A monthly payment of a set amount to come for only a specific amount of time. Hybrid: A combination of a lump sum (often to pay off a mortgage), monthly payments, and establishing the line of credit as a reserve.

Like other types of loans, there are certain costs associated with obtaining a Reverse Mortgage. These typically include:

Loan Origination Fee – This is how the lender is compensated.

Third-Party Fees (i.e., appraisal, inspection, lender title policy, etc.).

FHA Mortgage Insurance Premiums.

What are the Four Requirements of The Borrower?

There are four basic requirements for the HECM Reverse Mortgage. (1) The house must remain the principal residence of at least one of the borrowers, (2) the home must be maintained, (3) basic homeowner’s insurance must be kept in force, and (4) all property-related taxes must be paid.

How and When Does the Loan Get Repaid?

If the loan requirements are being met (see above), the loan does not have to be repaid until the last surviving borrower dies or permanently leaves the property, and the lender cannot force the borrowers to sell their home for the purpose of repayment. The homeowners may remain in the home for as long as they like, even if the outstanding loan balance, plus interest, is more than the value of the property. When the home is no longer being used as the primary residence, the cash advances, interest, and other financed charges must be repaid to the lender. One hundred percent of any remaining proceeds (beyond the amount that is owed) will belong to the borrower if they move, or to their estate if they decease. No debt is passed along to the borrowers’ beneficiaries. You can find out more at www.ItsJustAMortgage.com.

THE NEW REVERSE MORTGAGE AND RETIREMENT INCOME PLANNING | 7 STRATEGIES

Strategies for using the Reverse Mortgage have grown tremendously. From creating a backup plan for market volatility to providing a growing reserve for spending shocks, eliminating a monthly mortgage payment, building a bridge for Social Security deferral, or adding new retirement dollars through the HECM for Purchase program, the new Reverse Mortgage continues to flex its retirement income muscles and show its versatility.

Below I want to share a few, simple Reverse Mortgage retirement income strategies curated and collected over the last 20 years. This list is by no means conclusive, and it should not be considered financial advice, but it does reflect some of the current ways retirees and their advisors are using Reverse Mortgages to create greater retirement outcomes.

Eliminate a Mandatory Monthly Mortgage Payment

Recent estimates suggest that more than 50% of baby boomers will enter retirement with some sort of monthly loan payment. Using a Reverse Mortgage to pay off a traditional mortgage balance instantly increases a retiree’s monthly cash flow and can significantly reduce portfolio withdrawals.

Many retirees are accustomed to using a standard Home Equity Line of Credit (HeLOC) as a reserve to draw from for emergencies, expenses and enjoyment instead of drawing from their retirement savings. However, a Reverse Mortgage line of credit (ReLOC) is different in that it has a built-in, guaranteed growth factor (around 5% at time of printing). In addition, the line of credit can never be frozen, reduced or cancelled (if the homeowner meets the basic requirements of the loan). Best of all, there are no monthly loan payments required.

Fund Future Long-Term Care or Income Needs

A 65-year-old couple with no long-term care insurance may want to set up a Reverse Mortgage line of credit. With a home worth $400,000, their initial line of credit at current interest rates would be worth $162,796. Left untouched, the equity line could be worth $274,611 in 10 years, $463,227 in 20 years and $781,391 in 30 years. The couple could then draw from the line of credit for future long-term care costs.

Protect Your Portfolio

Sometimes a portfolio may decline significantly in value. When this happens, a retiree can borrow from the HECM line of credit for their needs instead of locking in the loss by drawing from the portfolio or annuity prematurely. They can repay the loan and replenish the line of credit when the portfolio recovers, if they choose.

Create an Income Bridge

Deferring Social Security for as long as possible is essential for most people. On the other hand, some simply need the money at 62 and don’t know how to supplement their income with any other resource. This is where they can establish a Reverse Mortgage and schedule monthly payments as an income bridge to allow retirees to delay claiming Social Security until benefits are worth the maximum amount at age 70. This strategy also allows them to defer taking IRAs and annuities, so they will have a larger benefit.

Manage Taxes | Roth Conversion

Proceeds from a Reverse Mortgage are tax-free, so tapping into the Reverse Mortgage dollars can decrease the amount a retiree needs to withdraw from taxable accounts. This simple action not only helps to reduce standard taxation, but also reduces the amount of Social Security benefits subject to income taxes. For higher-income retirees, tax-free Reverse Mortgage payments can reduce their modified adjusted gross income, which lowers the risk of higher monthly Medicare premiums.

Benefitting from tax-free retirement income is often very desirable. Sometimes the only obstacle preventing a retiree from converting a traditional retirement account to a Roth IRA is the amount of income taxes owed on the converted amount. If the client chooses tax-free proceeds from a Reverse Mortgage, they can pay Roth conversion taxes all at once or over several years, reducing future income taxes.

Buy a New Home

A Reverse Mortgage can be used to purchase a new home. Rather than using all the proceeds from a home sale, drawing from savings or taking out a traditional loan and making payments, the HECM for Purchase (H4P) can be used. For around 50%-60% down, a retiree can purchase a new home without required monthly payments. The additional cash saved can be added to accounts for future needs.

Get More Out of the Month

Some retirees have a budget that is designed to sustain them for all of retirement but leaves them lacking month to month. Converting the Reverse Mortgage into a monthly payment can accomplish two things. It may reduce the amount drawn from savings, allowing them to last longer, or it could increase the amount they can spend monthly, giving them more enjoyment. It’s like giving yourself a permanent raise in retirement.

IS A REVERSE MORTGAGE RIGHT FOR YOU?

Today’s Reverse Mortgages are being used by retirees of every economic status, whether it’s to create a growing standby line of credit to mitigate longevity, inflation, market or sequence risk, or to ensure a quality retirement. Reverse Mortgages are an important part of the retirement planning conversation.

The list above is just some of the many powerful retirement-shaping benefits of the new Reverse Mortgage. The truth is that as wonderful as the tool has become for many, we know they are not for everyone, and like any financial product, they come with benefits and risks.

My advice is for retirees to be wise. If you’re considering a Reverse Mortgage, do your homework and work with a trusted financial professional. Make sure you consult with your financial advisor to direct you towards a Reverse Mortgage partner or resource that understands retirement income principles and with whom your advisor feels comfortable.