Tax-Efficient Strategies to Pass Wealth to the Next Generation

3 Tax-Efficient Strategies to Pass Wealth Along to the Next Generation Available to Affluent, HNW, and UHNW Clients

By Christian Nwasike and Mark Purnell, PMC-LLC Coaches

A discussion on strategies financial advisors can leverage to deepen client relationships.

Strategy #1 - A coordinated tax planning meeting with all the family’s advisors (CPAs, attorneys, and asset managers).

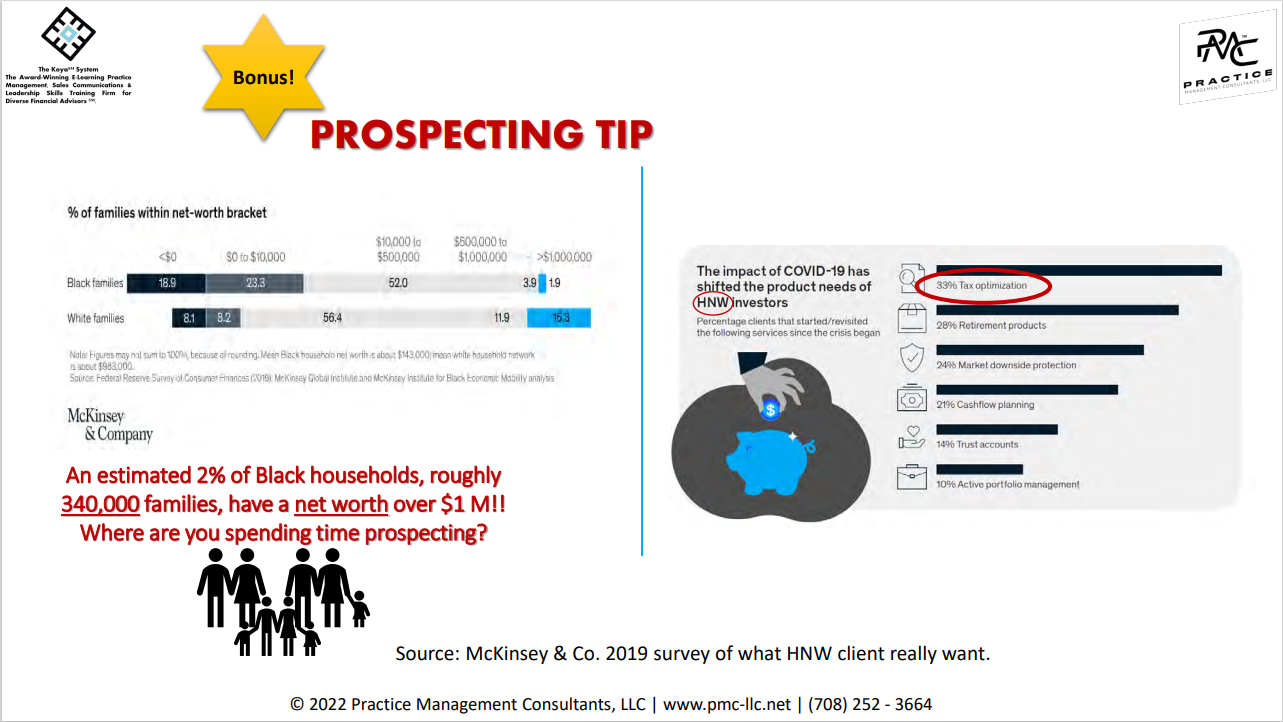

What do high-net-worth (HNW) clients really want?

Simplifying the Complicated

High-net-worth individuals (HNWIs) complex financial situations demand more tailored service with greater attention to detail than one-size-fits-all wealth managers can provide. This human touch is the secret ingredient to HNW wealth management, as it allows clients to trust and be guided by expert advice that is personalized based on a thorough understanding of their individual needs and financial situation.

Treating them as an individual.

Financial advisors aren’t consistently delivering this level of service. More than half of HNWIs surveyed by Gartner lack proactive support from their financial advisors/providers. This is a missed opportunity for financial advisors.

What can you do for your HNW clients that they can’t do for themselves?

According to Business Insider, there is $68 trillion in assets set to transfer to younger generations over the next 30 years. Financial advisors who target HNWIs must understand that HNWIs and families have a unique set of values for themselves, each other, and in most cases, for the wider community. It sounds very generic, but that is the key!

They would expect you, their advisor, to:

Ask for a call/meeting with their CPA to plan for taxes.

Prepare for your annual meetings by putting them on the calendar and asking for statements so that you can update their investment plan, distribution plan, and growth plan.

Schedule the planning meeting.

That’s what they want you to do. Clients love to see their advisers collaborating and making sure that strategies are being implemented across their portfolio. It is one of the biggest ways we can generate trust and thrill our clients.

Strategy #2 – Sharing benefits of charitable giving (i.e., leveraging Donor Advised Funds)

Donor advised fund

One of the most popular giving options today. Similar to a private foundation, a donor advised fund (DAF) provides an immediate full tax benefit and lets you donate to your favorite charities, but with less expense and setup.

Getting the conversation started

There are many considerations to take into account when it comes to your clients’ charitable aspirations. Consider posing some of these questions to help you get the conversation flowing.

Is your charitable cause or legacy important to you?

Will family members be involved after your passing?

Are you considering selling a business? Have you considered the impact of capital gains tax?

Are your investments highly concentrated? Are you looking for a way to diversify?

Have you decided to use the standard deduction? Did you consider the concept of bunching?

Do you have an existing foundation and want a simplified way to give to charities?

Are you currently giving to any charities? Which ones, and how much?

What do you want to accomplish through charitable giving?

Do you have an annual budget for your giving?

Are you making multi-year gifts to charities?

How are you engaging your children (grandchildren) in your philanthropy?

How involved do you want to be with your charitable giving?

Are there any causes or issues that you are most concerned about?

Strategy #3 - Discuss why clients should increase, protect, and plan to leave a legacy for their family.

Fixed Universal Life Insurance

This policy offers a wide range of choices regarding premium payments, allowing you to choose how much will be paid and when. Universal means flexible.

Premiums are flexible and are subject to specified minimums and maximums.

The life insurance amount, which is generally free from federal income tax, can be increased or decreased as necessary.

The cash value of the policy accumulates, income tax-deferred, at current interest rates.

Portions of the cash value, up to cost basis, may be withdrawn without paying income taxes, interest, or surrendering the policy. Amounts over the cost basis may be borrowed from the policy similar to the whole life policy.